arkansas estate tax return

This means that you may gift up to 15000 per person per year without worrying about tax consequences. The Estate Tax Return Due Date is the day of the ninth 9 th calendar month after the decedents death.

Arkansas State Tax Information Support

The federal government gives relief in the form of a basic tax exemption.

. Tax returns and on the Arkansas Fiduciary Return. Sales and Use Tax Forms. One 1 copy of the approved request must be attached to the return when filed.

At the federal level the federal gift tax makes an exclusion of 15000 per year per gift recipient. The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of. AR1000NOL Schedule of Net Operating Loss.

The following table outlines probate and estate tax laws in Arkansas. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc. The process however can take longer for contested estates.

The decedent and their estate are separate taxable entities. Currently the exemption stands at 545 million. Enter total allowable credits from AR1020BIC.

Arkansas Estate Tax Return andor Pay Estate Tax AR321E File this request in triplicate on or before the due date of the return. Effective tax year 2011 the completed AR8453-OL along with the AR1000F or AR1000NR any W-2s or schedules are to be kept in your files. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

AR1000NR Part Year or Non-Resident Individual Income Tax Return. Pay-by-Phone IVR 1-866-257-2055. Your Arkansasgov Governor Asa Hutchinson.

Attach a copy of the tax returns filed with the other states. The statewide property tax deadline is October 15. As far as gift taxes go Arkansas also does not have a state gift tax.

AR4FID Fiduciary Interest and Dividends. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. For faster service file your Sales and Use Tax Returns online at httpsataparkansasgov.

Learn about Arkansas income property and sales tax rates to estimate what youll pay on your 2021 tax return. Go to Income Tax Refund Inquiry. Arkansas state income tax rates range from 0 to 59.

In the case of the estate of a resident or a nonresident who dies having real property andor tangible personal property located in a state other than Arkansas the Arkansas tax due shall be a percentage of the Federal Credit Allowable for State Death Taxes in the same proportion. The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return ET-1 forms to taxpayers. Continue your conversation over the web email or SMS.

AR1000F Full Year Resident Individual Income Tax Return. These additional measures may result in tax refunds not being issued as quickly as in past years. Continue your conversation over the web email or SMS.

Arkansas has no estate or inheritance tax. As of january 1 2005 arkansas no longer imposes an estate tax. Online payments are available for most counties.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. AR321E Extension of Time to File Estate Tax Return. The median property tax in arkansas is 53200 per year for a home worth the median value of 10290000.

Find My Representative. In reality very few estates pass that threshold. A return for the estate or trust for which heshe acts provided any of the following apply.

AR1000RC5 Individuals With Developmental Disabilites Certificate. Emailing IndividualIncomedfaarkansasgov with your queries. Check the status of your Arkansas Income Tax return.

Calling the DFA or its tax hotline at 1-501-682-1100 or 1-800-882-9275. The Arkansas Department of Finance and Administration handles all state tax issues. Estate Tax Return Date.

Be sure to pay before then to avoid late penalties. Get instant answers to hundreds of questions about government services. Limits any increase in taxable value due to a reappraisal to 5 per year on the owners primary place of residence.

Therefore only estates whose value exceeds 545 million will owe federal estate tax. Any income of such estate or trust is currently distributable. AR1002F Fiduciary Income Tax Return.

IRS Form 1041 US. The 2021 Arkansas State Income Tax Return forms for Tax Year 2021 Jan. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022.

If you gift more than that amount to someone you must report it to. This tax is item 5b on the Arkansas Estate Tax Return Form. In fact only an estimated two out of every 1000 estates owe federal estate tax.

Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals. This is a quick summary of Arkansas probate and estate tax laws. For questions about individual state income tax there are a few ways you can get help.

An estates tax ID number is called an employer identification. Before filing Form 1041 you will need to obtain a tax ID number for the estate. If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL.

AR1000-OD Organ Donor Donation. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face.

Your Arkansasgov Governor Asa Hutchinson. Arkansas Probate and Estate Tax Laws. Get instant answers to hundreds of questions about government services.

Contact 501-682-7104 to request ET-1 forms and the forms will be mailed to your business in two to three weeks. Check your refund status at.

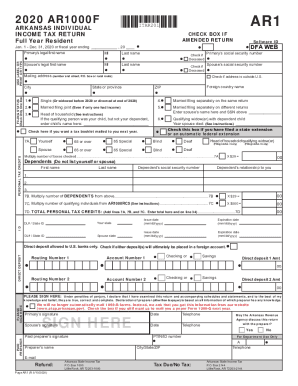

Arkansas State Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

Arkansas Sales Tax Exemption Form Form Tax Arkansas

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

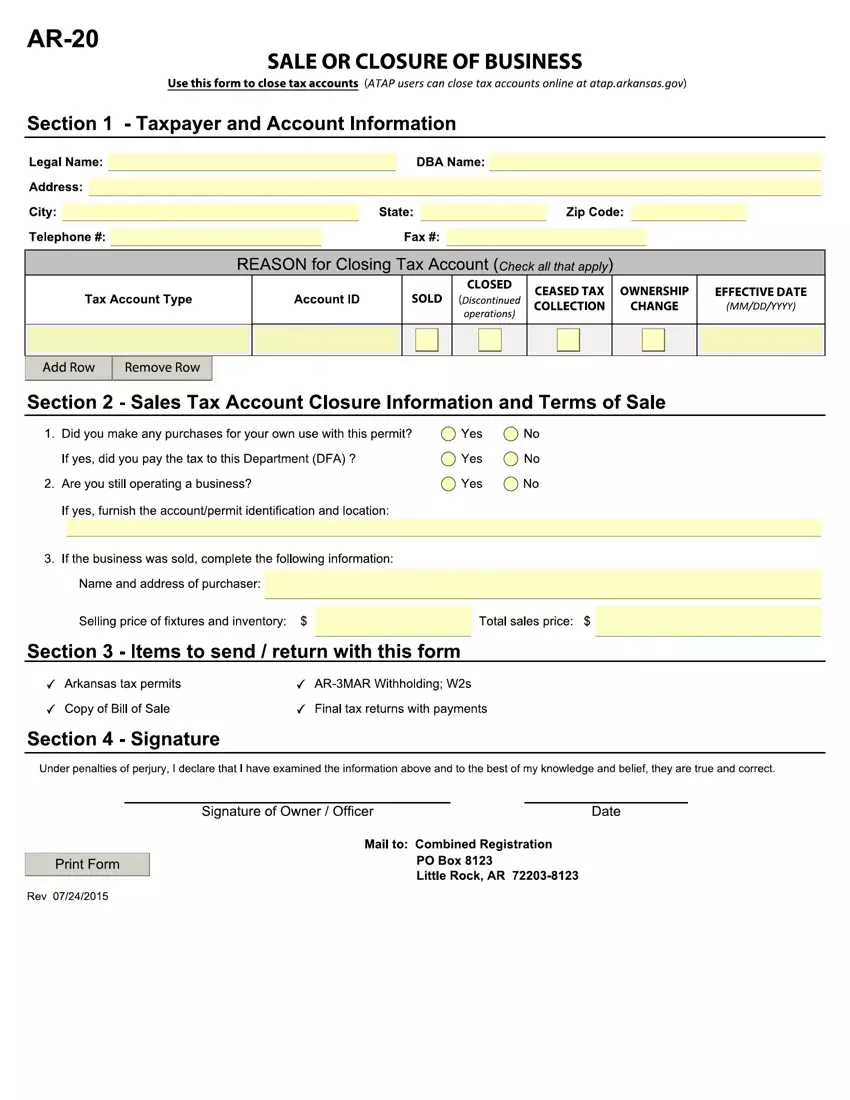

Ar 20 Form Fill Out Printable Pdf Forms Online

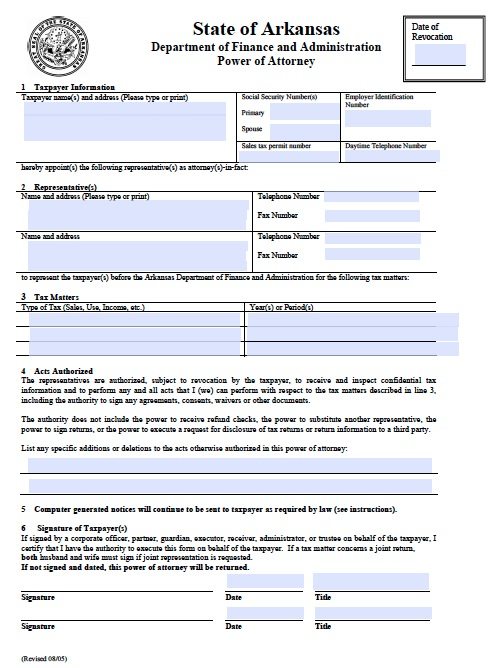

Free Tax Power Of Attorney Arkansas Form Fillable Pdf

Where S My Refund Arkansas H R Block

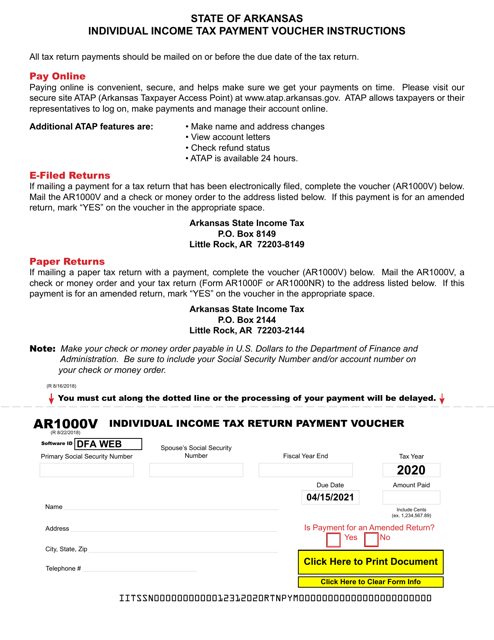

Form Ar1000v Download Fillable Pdf Or Fill Online Individual Income Tax Return Payment Voucher 2020 Arkansas Templateroller

Arkansas Inheritance Laws What You Should Know

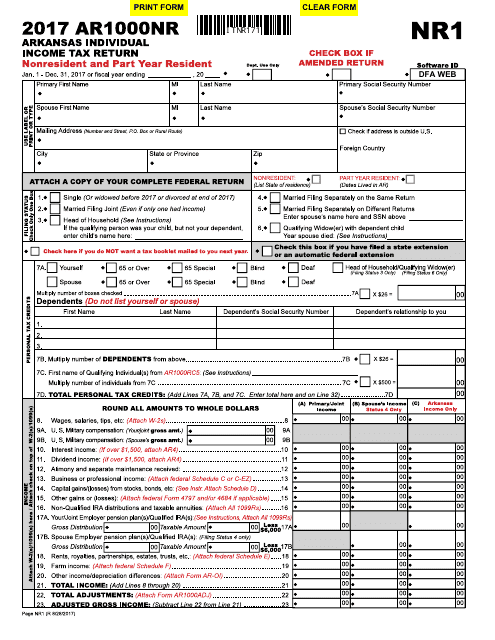

Form Ar1000nr Download Fillable Pdf Or Fill Online Arkansas Individual Income Tax Return Nonresident And Part Year Resident 2017 Arkansas Templateroller

Lawyer Documents Free Printable Documents Legal Documents Documents Lawyer

Arkansas State 2022 Taxes Forbes Advisor

How To File And Pay Sales Tax In Arkansas Taxvalet

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

New Kid On The Block New England Home Magazine House And Home Magazine Boston Design New England Homes

Manufactured Home Features Testimonials Clayton Homes Mobile Home Exteriors House Exterior

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Ohio Quit Claim Deed Form Quites Ohio Marital Status

Printable Sample Rental Application Template Form Rental Application Application Form Legal Forms